Menu

| File | > | Profiles | > | Financial Profiles | > | On-Charge Profile |

Mandatory Prerequisites

Prior to creating an On-Charge Profile, refer to the following Topics:

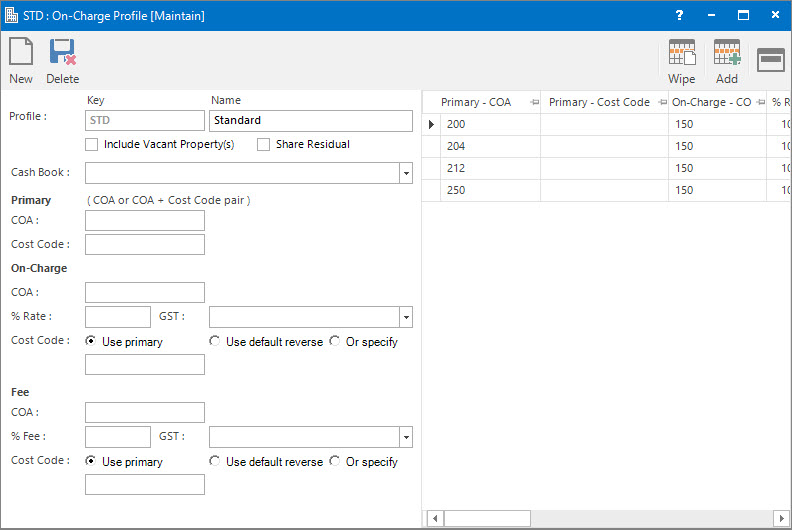

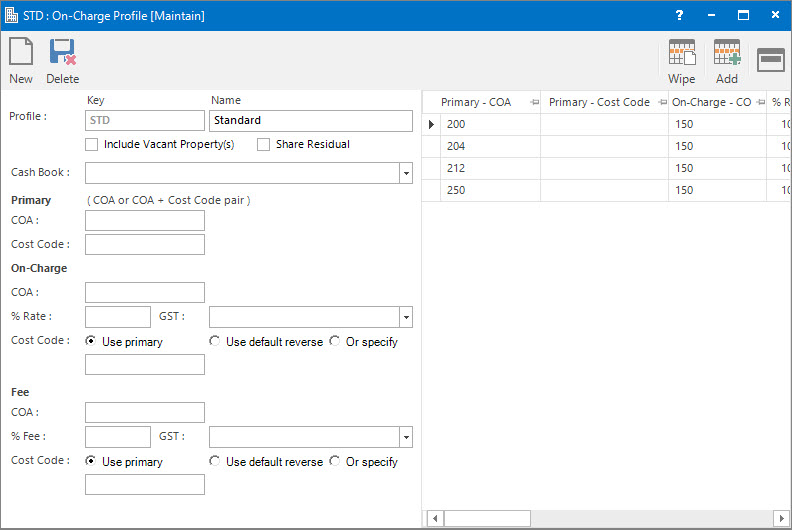

Screenshot and Field Descriptions

Header Fields:

These apply to the whole Profile.

Profile - Key: this is the primary identifier for the On-Charge Profile.

Profile - Name: this is the descriptive name of the On-Charge Profile.

Include Vacant Property(s): this check box specifies if the areas of vacant properties should be included when apportioning the Creditor transaction to Tenants.

Share Residual: this check box specifies if the residual area of a property, ie. area of property that is not leaseable, is included when apportioning the Creditor transaction to Tenants.

Cash Book: this is the Bank account if the Tenant transactions raised are going to be a Cash Sales / Cash Credit type transaction. Leave blank if a Invoice / Credit Note type transaction is to be raised.

Profile Line Items:

Multiple line items can be entered for a Profile. Each line specifies how amounts entered for a Chart of Account on a Creditor transaction will be treated when creating the Chart of Account line items on the Tenant transactions.

Primary

COA: this is the Chart of Account ID (usually Expense) on the Creditor transaction.

If an On-Charge COA has been specified on the Chart of Account maintenance screen for this COA, its value will be populated in the On-Charge - COA field.

Cost Code: this is an optional Cost Code ID on the Creditor transaction.

On-Charge

COA: this is the Chart of Account ID (usually Income) to use on the Tenant transaction that will be created.

% Rate: this specifies how much of the amount to on-charge. If the full amount is to be on-charged enter 100%.

GST: this is the GST Type to apply. It will default to the type set up for the COA.

Cost Code: select from the options provided:

- Use primary: tick this option to use the Primary - Cost Code.

- Use default reverse: tick this option to use the On-Charge Cost Code entered on the Cost Code maintenance screen for the Primary - Cost Code.

- Or specify: tick this option to use the entered Cost Code in the field below.

Cost Code: this is the specified Cost Code ID to use.

Fee

Enter values in these fields if an additional handling fee is going to be charged to Tenants.

COA: this is the Chart of Account ID to use on the Tenant transaction for the fee.

% Fee: this is the percentage of the on-charged amount to raise as an additional fee.

GST: this is the GST Type to apply to the fee amount.

Cost Code: select from the options provided:

- Use primary: tick this option to use the Primary - Cost Code.

- Use default reverse: tick this option to use the On-Charge Cost Code entered on the Cost Code maintenance screen for the Primary - Cost Code.

- Or specify: tick this option to use the entered Cost Code in the field below.

Cost Code: this is the specified Cost Code ID to use.

Profile Lines table: this contains rows of Profile Line Items that have been entered. New ones can be added. Existing ones can be deleted or changed by selecting and double clicking. Their content can be maintained in the Profile Line Item fields to the left of this table.

How Do I : Search For and Maintain Entities

These General Rules are described in the Fundamentals Manual: How Do I : Search For and Maintain Entities

How Do I : Add a new On-Charge Profile

Header Fields:

These apply to the whole Profile:

Profile Line Items:

Repeat for each Profile Line:

Final:

How Do I : Modify an existing On-Charge Profile

How Do I : Delete an existing On-Charge Profile

On-Charge Profiles are associated with the following Topics: